McKinsey recently released a report titled “Is industrial automation headed for a tipping point?”, analyzing two scenarios to reveal the most probable paths for the future of industrial automation: one is improvement, and the other is transformation. The report also examines how businesses can respond to these changes.

Is industrial automation still a slow-developing track, or has it crossed the divide and entered a soon-to-be rapid growth avenue?

McKinsey’s recent report, “Is industrial automation headed for a tipping point?”, provides intriguing insights. As we perceive it, factories are moving towards greater automation and autonomy. Software-defined and AI-driven technologies are sweeping through the shop floors, and many devices are becoming more akin to smartphones with mechanical arms. Not only the products produced in factories, such as smartphones, watches, and cars, are becoming smarter, but in a sense, the factories themselves can be seen as a “product,” where each factory can utilize advanced processes and experiences packaged by other factories.

This report analyzes two scenarios, aiming to uncover the most probable paths for the future of industrial automation: one is through improvement, optimizing and enhancing existing automation technologies to achieve more efficient and intelligent production. The other scenario is transformative innovation, introducing entirely new technologies and methods to fundamentally change industrial automation.

The report offers valuable insights and recommendations for businesses to make informed decisions amid the development of industrial automation. Whether choosing to improve existing technologies or invest in transformative innovation, companies need to comprehensively assess their own situations and market demands while formulating corresponding strategies to address future challenges and opportunities.

Scenario 1: Improvement (Over 15 years)

Gradual Evolution

The adoption of technology trends at a slow pace, remaining consistent with the past rate of change. Standardization processes are slow, and innovations such as low-code/no-code and digital twins are only used for specific use cases and industries.

Scenario 2: Transformation (5-10 years)

Rapid Transformation

The adoption of disruptive technologies has given rise to data-driven and software-enabled workshops. Companies actively embrace new business models, extensively utilize cloud services, and form ecosystems centered around core platforms.

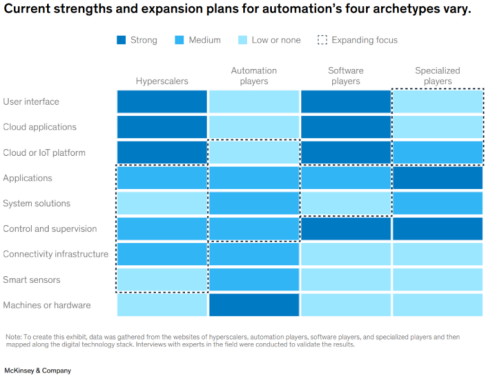

The report also categorizes participants in the industrial automation market into four major categories: Internet giants, traditional automation companies, software providers, and specialized participants. The conclusion is that if manufacturing companies adopt digital technologies in the short term and follow the path of “Scenario 2: Transformation,” Internet giants will be the most proactive actors and the biggest beneficiaries.

In other words, if the industrial automation market follows a transformational path of 5-10 years, it may result in companies like Amazon, Microsoft, Alibaba, and Tencent expanding their market share, potentially taking shares away from traditional industrial automation companies such as Siemens, ABB, Honeywell, and Emerson.

However, if technologies like Soft PLC, industrial AI, and industrial wireless do not break through the tipping point of growth, industrial automation may experience slower growth and only become widely adopted around 2040.

Regardless of the scenario, small and medium-sized automation companies and end-users in the manufacturing field will benefit. McKinsey encourages Internet giants and traditional automation companies to strengthen ecological cooperation, gain necessary industry knowledge through partnerships, or expand capabilities through acquisitions.

End-users can consider both Internet giants and traditional automation companies as alternative suppliers, introducing evenly matched participants to their advantage.

This article aims to dissect the highlights of the report and the latest industrial automation technologies worth attention. The content is divided into the following three parts:

- Two Future Scenarios of Industrial Automation: Improvement or Transformation? and their Response Recommendations.

- Current Overview of the Industrial Automation Market: Beyond Efficiency and Cost, the New Dimensions of Industrial Automation.

- Impact of New Automation Technologies: Simplification and Standardization as the Magic Wand to Break the Proof of Concept (PoC) Curse.

The Future Scenarios of Industrial Automation: Improvement or Transformation?

McKinsey believes that the field of industrial automation, which has been steadily evolving, is now at a crossroads of non-linear competition and technological transformation, with two paths ahead: “Scenario 1: Improvement” and “Scenario 2: Transformation.”

In Scenario 1, the widespread adoption of fully automated manufacturing in most companies will take at least 15 years, until around 2040. In this gradual improvement scenario, the most innovative technologies will generate certain specific applications by around 2030, and the implementation of each automation technology will still require a longer period of validation and verification. From a talent perspective, the essential skills remain relatively unchanged. Overall, there is not much difference compared to the current state.

In Scenario 2, the widespread adoption of fully automated manufacturing in most companies is expected to be achieved within the next 5 to 10 years, with many factories achieving a more comprehensive digitalization by 2035. In this transformative scenario, McKinsey predicts that by 2030, all information processing tasks will be completed by edge-cloud platforms, and typical manufacturing factories will achieve end-to-end process automation, use more standardized solutions, and have more open ecosystems.

From a business model perspective, the software and hardware used in factories will adopt the “X-as-a-Service” model, where payment is based on usage, thereby reducing the risks and costs for factories to try out new automation technologies. From a talent perspective, manufacturing companies will require more specialized digital transformation positions to manage the new industrial automation systems.

Although industrial automation has been steadily developing over the past few decades, the market structure has hardly changed. McKinsey believes that due to the emergence of disruptive technologies, shifts in the manufacturing landscape, labor shortages, and macro trends like ESG, the pace of industrial automation transformation is accelerating.

The vision of intelligent manufacturing will undoubtedly be realized, but McKinsey does not provide a specific timeframe for achieving this vision, whether it will take 5 to 10 years or more than 15 years.

In the market, the four main categories of suppliers, including Internet giants, traditional automation companies, software providers, and specialized participants, will dynamically develop based on their own strengths. Their strengths and weaknesses are evident, as shown in the chart below, with darker colors representing their strengths, gradually becoming lighter as capabilities decrease.

In order to address their weaknesses, Internet giants need to expand their knowledge in the industrial domain and establish partnerships with mature automation vendors and system integrators. Traditional automation companies may consider increasing the proportion of IT capabilities, strengthen their advantages in cloud platforms, software, and the Internet of Things (IoT) through mergers and acquisitions or ecosystem collaboration.

Regardless of which scenario unfolds, we can be prepared, and the near future presents an opportune time for us to strategize. Therefore, McKinsey proposes some potential action plans for industrial automation companies after 2023:

- Review Automation Portfolio Strategy: Evaluate the potential impact of automation scenarios on business and include merger opportunities in the review.

- Establish New Automation Businesses: Companies can create internal ventures within specific departments to establish independent automation businesses similar to startups.

- Advance Business Strategies: Redefine business strategies by changing channels or models.

- Develop New Revenue Sources: Create new products, such as building new products around predictive maintenance or transforming existing products into new “X-as-a-Service” models.

- Embrace Artificial Intelligence Technologies: Companies should seriously consider adopting AI technologies, including generative AI, and develop new products based on technologies like digital twins and low-code robots.

For end-users, McKinsey also provides specific recommendations to adopt after 2023:

- Initiate Automation Diagnostics: Factories can identify unknown automation opportunities through diagnostics.

- Undertake End-to-End Automation Transformation: Start from key areas and gradually extend to end-to-end transformation.

- Initiate Work Transformation: Many management theories and work methods were developed during the industrial age and may not be suitable for the digital era. Recruitment, skill improvement, and training will be essential for years to come.

Bold assumptions should be made with cautious verification. While “ensuring success” might seem like a prerequisite for making decisions, the world is not certain, and accepting uncertainty is a shared practice. The harsh reality is that those who seek “absolute success” are more likely to fall into decision traps.

Although nobody can predict how the future of industrial automation will unfold, we can all prepare for tomorrow. From a perspective of success and failure, winners only need to gain relative advantages in certain areas to achieve a leading position.

Beyond efficiency and cost, new dimensions of industrial automation

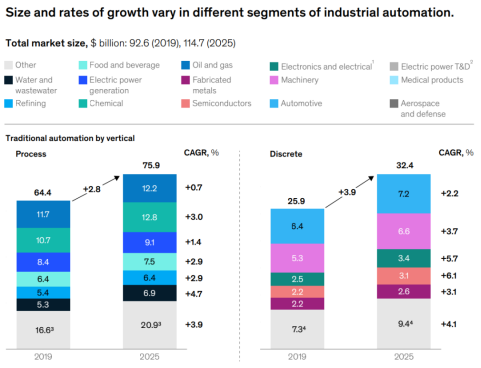

In the report, McKinsey has provided statistics on the current development status of industrial automation, and by 2025, the overall market size is expected to reach $115 billion USD, divided into three specific segments: Classic Automation – Process Industries, Classic Automation – Discrete Industries, and Industrial IoT and Cloud Services.

In the report, McKinsey has provided statistics on the current development status of industrial automation, and by 2025, the overall market size is expected to reach $115 billion USD, divided into three specific segments: Classic Automation – Process Industries, Classic Automation – Discrete Industries, and Industrial IoT and Cloud Services.

- Classic Automation – Process Industries: So far, the process industries have had the highest expenditure on traditional automation equipment, with control systems typically having the largest scale and longer purchasing duration. According to McKinsey’s forecast, by 2025, the total expenditure in the process industries will reach approximately $76 billion USD, with a compound annual growth rate of 2.8%. The oil and gas sector is the largest automation buyer in the process industries, slightly higher than the chemical industry, but with the slowest growth rate.

- Classic Automation – Discrete Industries: Discrete industries produce based on orders, and workshops are often distributed in different regions. The expenditure on automation in this sector is relatively low, but the growth rate is fast, with a compound annual growth rate of approximately 3.9%. Among various industries in discrete manufacturing, the semiconductor and electronics sectors show the fastest growth in automation spending.

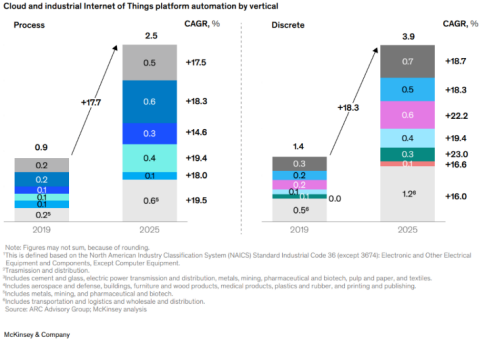

- Industrial IoT and Cloud Services: This segment includes Industrial IoT and cloud service solutions for both process and discrete industries. Currently, this area is still in its early stages, but it is experiencing the fastest growth, with a compound annual growth rate of approximately 18%, and the supplier landscape is relatively concentrated.

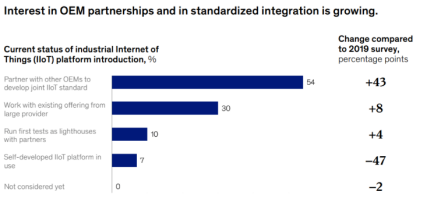

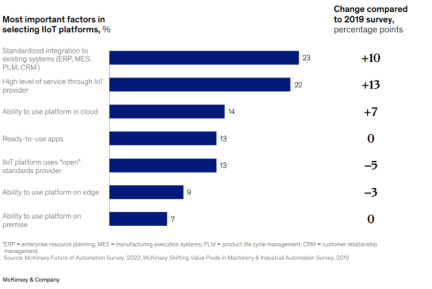

In terms of changes and constants, since 2019, there has been an eight-fold increase in the proportion of end-users prioritizing external partners to deploy standardized Industrial IoT platforms.

In the past few years, there has been a shift in focus among end-users. They are no longer concerned about who develops the Industrial Internet of Things (IIoT) platform. Instead, users have shifted from developing IIoT platforms themselves to deploying standardized IIoT platforms through OEM and other partnerships.

The importance of digital solutions has also increased, with 69% of respondents stating that digital systems have become a crucial component of automation, and 94% of respondents believing that digital solutions are particularly important for future automation work.

Survey respondents indicate that the standardization of IIoT platforms and their ease of integration with existing traditional software systems are the most critical selection factors. The level of service provided by IIoT vendors is the next consideration.

End-users consider open standards more important than vendor capabilities, and these preferences will have a significant impact on the evolution of future IIoT platforms.

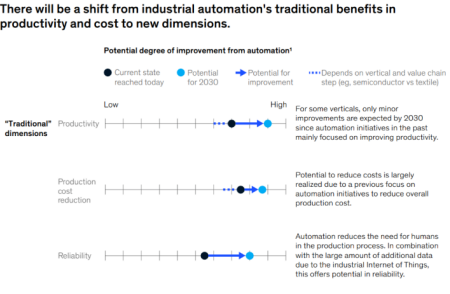

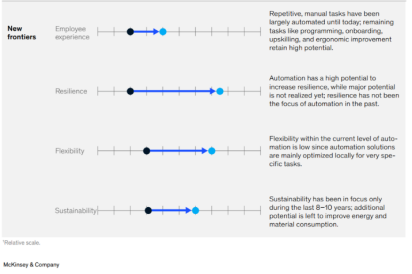

The changing aspects also include how users assess automation’s contribution to enhancing factory efficiency, going beyond the traditional dimensions of production efficiency and cost-effectiveness.

The newly added dimensions include employee work experience, factory resilience, flexibility, and sustainability.

Technologies such as additive manufacturing and digital twins can enhance the factory’s resilience, reducing potential impacts and risks to the company’s supply chain. Digital twins also allow businesses to simulate the effects on equipment or factories after unexpected events, enabling proactive countermeasures.

Wireless communication technologies like 5G and Wi-Fi 6 can track the condition of large-scale equipment, reduce latency, and make logistics more flexible.

With these latest technologies, factories can quickly switch production lines, breaking free from the constraints of traditional assembly lines and adopting a matrix approach to manufacturing. Matrix production involves using flexible units in the workshop to produce parts, rather than a long and continuous assembly line.

Industrial automation can also enhance a company’s sustainability by reducing energy consumption and waste generation.

Simplification and standardization are the keys for these new technologies to break free from the Proof of Concept (PoC) dilemma.